AQR Multi-Asset Fund

AQRIX

Seeks capital appreciation.

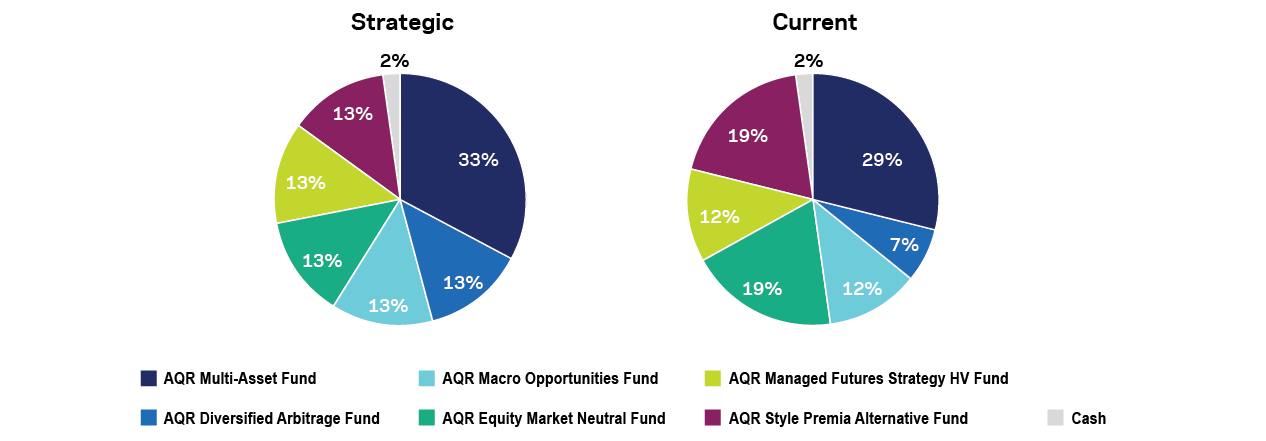

The Fund seeks attractive long-term risk-adjusted returns through strategic allocations to AQR alternative mutual funds.

Leveraging AQR’s research and 20-year track record in alternative investing, the Fund is designed to complement an investor’s traditional stock and bond portfolio. The Fund invests in a portfolio of AQR mutual funds, providing exposure to both Active Multi-Asset strategies and Absolute Return strategies:

The Fund seeks to provide an all-in-one solution for investors seeking a strategic, long-term approach to alternatives.

The Fund seeks reduced sensitivity to stock and bond market movements, which can help improve portfolio resilience across various market environments.

The Fund offers diversified exposure to a range of alternative strategies and return sources.

As of March 29, 2024

| MTD | YTD | 1YR | 3YR | Since Inception 6/8/2020 | Gross Expense Ratio | Net Expense Ratio* | |

|---|---|---|---|---|---|---|---|

| AQR Diversifying Strategies Fund | 5.05% | 11.23% | 21.10% | 12.82% | 13.57% | 2.38% | 2.37% |

| ICE BofA US 3M T-Bill Index | 0.45% | 1.29% | 5.24% | 2.58% | 2.05% |

| AQR Diversifying Strategies Fund | ICE BofA US 3M T-Bill Index | |

|---|---|---|

| MTD | 5.05% | 0.45% |

| YTD | 11.23% | 1.29% |

| 1YR | 21.10% | 5.24% |

| 3YR | 12.82% | 2.58% |

| Since Inception 6/8/2020 | 13.57% | 2.05% |

| Gross Expense Ratio | 2.38% | |

| Net Expense Ratio* | 2.37% |

As of March 29, 2024

| QTD | YTD | 1YR | 3YR | Since Inception 6/8/2020 | Gross Expense Ratio | Net Expense Ratio* | |

|---|---|---|---|---|---|---|---|

| AQR Diversifying Strategies Fund | 11.23% | 11.23% | 21.10% | 12.82% | 13.57% | 2.38% | 2.37% |

| ICE BofA US 3M T-Bill Index | 1.29% | 1.29% | 5.24% | 2.58% | 2.05% |

| AQR Diversifying Strategies Fund | ICE BofA US 3M T-Bill Index | |

|---|---|---|

| QTD | 11.23% | 1.29% |

| YTD | 11.23% | 1.29% |

| 1YR | 21.10% | 5.24% |

| 3YR | 12.82% | 2.58% |

| Since Inception 6/8/2020 | 13.57% | 2.05% |

| Gross Expense Ratio | 2.38% | |

| Net Expense Ratio* | 2.37% |

Performance data quoted represent past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. All returns shown are total returns that assume reinvestment of dividends and capital gains. Returns for periods under a year are cumulative, all others are average annual returns. Investment returns and principal will fluctuate with market and economic conditions and you may have a gain or loss when you sell shares. From time to time the Fund’s advisor may waive fees or reimbursed expenses, without which performance would have been lower. Please call 866-290-2688 for most recent month-end performance.

ICE Bank of America Merrill Lynch 3 Month T-Bill Index: An index that tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. Indexes are unmanaged and one cannot invest directly in an index.

The Adviser has contractually agreed to reimburse operating expenses of the Fund at least through April 30, 2024. The Expense Limitation Agreement may be terminated with the consent of the Board of Trustees.

Performance data quoted represent past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. All returns shown are total returns that assume reinvestment of dividends and capital gains. Returns for periods under a year are cumulative, all others are average annual returns. Investment returns and principal will fluctuate with market and economic conditions and you may have a gain or loss when you sell shares. From time to time the Fund’s advisor may waive fees or reimbursed expenses, without which performance would have been lower. Please call 866-290-2688 for most recent month-end performance.

Founding Principal

Ph.D., M.B.A., University of Chicago

B.A., University of Chicago

Principal

Ph.D., M.A., New York University

B.A., Boston College

Principal

Ph.D., Yale University

M.S., London School of Economics

B.S., University of Rome III

Principal

S.B., Massachusetts Institute of Technology

.jpg?sc_lang=en)

A.B., University of Chicago

M.A., University of California - San Diego

Ph.D., New York University

Principal

B.S., B.S., University of Pennsylvania

| Individual Investors | $5 Million |

|---|---|

| Institutional Investors | None |

| Accounts Offered by Financial Advisors | None |

| Sales Load | None |

|---|---|

| Deferred Sales Load | None |

| Redemption Fees | None |

| Management Fee | 0.00% |

|---|---|

| Distribution (12b-1) Fee | None |

| Other Expenses | |

| Dividends On Short Sales and/or Interest Expense | None |

| All Other Expenses | 0.21% |

| Acquired Fund Fees | 2.17% |

| Gross Expenses | 2.38% |

| Less: Expense Reimbursements | 0.01% |

| Net Expenses* | 2.37% |

| Adjusted Expense Ratio** | 1.28% |

|---|

**Reflects the Net Expense Ratio adjusted for certain investment related expenses, such as interest expense from borrowings and repurchase agreements and dividend expense from investments on short sales, incurred indirectly by the Fund through investments in underlying mutual funds, none of which are paid to the Adviser. The Adviser has contractually agreed to reimburse operating expenses of the Fund at least through April 30, 2024. The Expense Limitation Agreement may be terminated with the consent of the Board of Trustees.

Information about how each Fund voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30 will be available no later than August 31. Please click here to view the most recent Form N-PX for the AQR Funds.

PRINCIPAL RISKS:

There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

The Fund is new and has a limited operating history.

The Fund is not a complete investment program and should be considered only as one part of an investment portfolio. The Fund is more appropriate for long-term investors who can bear the risk of short-term NAV fluctuations, which at times, may be significant and rapid, however, all investments long- or short-term are subject to risk of loss. Due to the Fund’s strategy of investing in underlying funds (“affiliated funds”), shareholders bear both their proportionate share of expenses in the Fund and, indirectly, the expenses of such affiliated funds.

The affiliated funds will enter into short sales and/or make investments in futures contracts, forward contracts, options, swaps and other derivative instruments. These derivative instruments provide the economic effect of financial leverage by creating additional investment exposure to the underlying instrument, as well as the potential for greater loss. If an affiliated fund uses leverage through activities such as entering into short sales or purchasing derivative instruments, the affiliated fund has the risk that losses may exceed the net assets of the affiliated fund. The Fund could miss attractive investment opportunities by underweighting strategies that subsequently experience significant returns and could lose value by overweighting strategies that subsequently experience significant declines.

Derivatives may be more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the fund’s original investment. Alternative investments strategies can be subject to increased risks and costs and investors must determine if the addition of these types of investments is appropriate for their specific financial objectives. Diversification and asset allocation do not ensure a profit or guarantee against a loss.

An investment in accordance with the Fund’s strategy is subject to risks, including the possibility that the value of the portfolio holdings may fluctuate in response to events specific to the companies in which the affiliated funds invest, as well as economic, political or social events in the United States or abroad. International investments are subject to certain risks, including currency movements and social, economic and political uncertainties, which could increase volatility. These risks are heightened in emerging markets. Commodities and futures generally are volatile and involve a high degree of risk. Investments in alternative strategies employ complex investment strategies and carry substantial risk. There can be no assurance a fund’s investment objective or strategies will be successful. Investing involves risk, including risk of loss.

Given the complexity of the investments and strategies of the affiliated funds, the Multi-Strategy Team relies heavily on quantitative models and information and data supplied or made available by third parties. There is no guarantee that the use of the models and data will help the affiliated funds achieve their objectives. When selecting investments for the Fund, the AQR Multi-Strategy Team limits its selection to AQR mutual funds, so they will select AQR mutual funds even in cases where there are third party mutual funds that are less expensive, or that have longer track records or higher historical returns. AQR has a conflict of interest when it establishes the Fund’s target asset classes, asset allocation objectives or ongoing allocations, because it will allocate only to asset classes where AQR mutual funds are available.

The information is intended to be educational and is not tailored to the investment needs of any specific investor. The information presented herein should not be the primary basis of your investment decisions. You should carefully research any fund you may be considering prior to making an investment decision. Another allocation and other investments, including non-AQR funds, having similar risk and return characteristics may be available. We suggest only AQR funds for the Fund and other fund families may have other options available, including funds with different features and costs.

We can change or update the Fund at any time. Neither AQR nor ALPS will notify you when they are updated. The Fund does not attempt to consider the effect of income taxes on performance or returns and do not reflect any opinion on the tax-appropriateness of the portfolio for any investor. The Fund does not consider the effect of taxes, fees and/or expenses associated with investing. Please consult with your investment or tax advisor, if applicable, prior to taking action.

AQR is the investment adviser to the AQR mutual funds included in the Fund and is entitled to receive an advisory fee from each fund, as reflected in the fund’s prospectus. Additional investments in the AQR mutual funds selected the Fund can lead to additional advisory fees paid to AQR.

© AQR Funds are distributed by ALPS Distributors, Inc. AQR Capital Management, LLC is the Investment Manager of the Funds and a federally registered investment adviser. ALPS Distributors is not affiliated with AQR Capital Management.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus or summary prospectus containing this and other important information, please call 1-866-290-2688 or click here to view or download a prospectus online. Read the prospectus carefully before you invest.

View definitions of benchmarks and other terms used here.

Diversification does not eliminate risk. Indexes are unmanaged and one cannot invest directly in an index.

Prior to October 18, 2021 the AQR Macro Opportunities Fund was known as the AQR Global Macro Fund.

The information provided herein (including any separate documents that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information about our products and services and to otherwise provide general investment education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as none of AQR Capital Management, LLC (“AQR Capital”) nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act of 1974, as amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein. If you are an individual retirement investor, contact your financial advisor or other fiduciary unrelated to AQR about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

There are risks involved with investing including the possible loss of principal.

Past performance does not guarantee future results.

©2023 AQR Funds. All rights reserved.