AQR Sustainable Long-Short Equity Carbon Aware Fund

Quick Links

- daily nav $13.15

- change $0.09

- daily return 0.69%

- inception date 12/16/2021

- AUM $32MM

Investment Objective

A Sustainable Approach to Alternative Investing

This Fund invests long and short across global equity markets, integrating certain Environmental, Social, and Governance (“ESG”) considerations into its security selection and portfolio construction processes and seeking to hedge climate risks. The resulting portfolio may allow investors to capitalize on diversifying return potential from an alternative strategy while investing responsibly. With twenty years of experience in systematic, sustainable investing, we believe AQR is uniquely positioned to manage the industry’s first sustainable long-short equity mutual fund.

Investment Approach

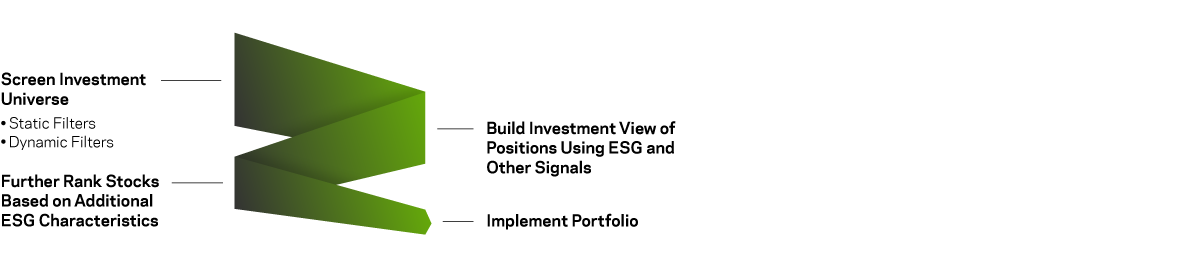

To start constructing the sustainable portfolio, we use ESG characteristics to narrow down the investment universe. These ESG characteristics, determined using a combination of AQR models and third party ESG data, identify the extent to which each company in the investment universe is exposed to, and how well it manages, a range of ESG issues. We utilize static ESG filters based on third party data to seek to prohibit the purchase of industries with particularly poor ESG characteristics, such as tobacco, controversial weapons, and fossil fuels. We also apply dynamic ESG filters, which use third party data to seek to prohibit the purchase of companies ranked approximately in the bottom 10% for their ESG characteristics. Once these filters have been applied, we use a set of value, momentum, quality, sentiment and other quantitative investment indicators to generate a long-short portfolio based on our global security selection model with weighting based on each position’s attractiveness or unattractiveness. The resulting portfolio will maintain a moderate net long exposure to global equity markets.

Why Invest in the Sustainable Long-Short Equity Carbon Aware Fund?

Diversifying and Sustainable Sources of Return

Stronger Expression of ESG Views

Seeks to Hedge Against Climate Risk

ESG Investing at AQR

In recent years, there has been increased political, regulatory, and social emphasis on sustainability practices in the investment community. The importance of global issues such as climate change and workplace inequality has been brought to the forefront, causing investors and asset managers to prioritize their ESG efforts.

AQR is committed to helping our clients achieve their ESG goals. As a leader in systematic, sustainable investing, we continue to expand our commitment to ESG through research, product innovation, and industry partnerships. As a firm, we integrate ESG in both our asset selection and ownership decisions, which are guided by the responsible investment framework we created with the UN PRI. Learn more about AQR’s approach to responsible asset selection and responsible ownership here.

ESG at AQR

In this video introduction, we discuss the basics of ESG investing and how we incorporate ESG information into our strategies at AQR.

Top 5 Long Equity Holdings

As of March 31, 2024

| Nvidia | 2.50% |

|---|---|

| Amazon.com | 2.45% |

| Apple | 2.31% |

| Honda | 1.33% |

| Mizuho | 1.30% |

Top 5 Short Equity Holdings

As of March 31, 2024

| Ferrari | -1.18% |

|---|---|

| T-Mobile US | -1.03% |

| Keyence | -1.03% |

| Nitori Holdings | -1.00% |

| Celanese US DE | -0.96% |

Sector Exposures

As of March 31, 2024

| Net | Long | Short | |

|---|---|---|---|

| Communication Services | 1.69% | 10.22% | -8.54% |

| Consumer Discretionary | 10.75% | 41.13% | -30.38% |

| Consumer Staples | 3.09% | 15.04% | -11.96% |

| Energy | 3.63% | 5.81% | -2.17% |

| Financials | 25.07% | 41.01% | -15.94% |

| Health Care | -1.22% | 18.80% | -20.02% |

| Industrials | 16.91% | 45.63% | -28.72% |

| Information Technology | 18.72% | 35.16% | -16.44% |

| Materials | -2.95% | 11.08% | -14.03% |

| Real Estate | -2.61% | 3.64% | -6.25% |

| Utilities | -2.39% | 5.51% | -7.89% |

| Total | 70.68% | 233.03% | -162.35% |

Country Exposures

As of March 31, 2024

| Long | Short | |

|---|---|---|

| Australia | 4.93% | -2.40% |

| Belgium | 0.98% | -0.80% |

| Canada | 5.52% | -3.87% |

| Denmark | 1.99% | -1.48% |

| Finland | 1.26% | -0.28% |

| France | 6.87% | -4.66% |

| Germany | 6.89% | -5.74% |

| Hong Kong | 1.62% | -1.04% |

| Italy | 4.79% | -3.61% |

| Japan | 34.41% | -25.10% |

| Netherlands | 3.20% | -1.63% |

| Norway | 1.12% | -0.53% |

| Singapore | 0.69% | -0.19% |

| Spain | 3.53% | -1.41% |

| Sweden | 4.16% | -3.46% |

| Switzerland | 5.83% | -4.92% |

| United Kingdom | 13.89% | -8.77% |

| United States | 131.36% | -92.47% |

| Total | 233.03% | -162.35% |

Portfolio Statistics

As of March 31, 2024

| # of long holdings | 1004 |

|---|---|

| # of short holdings | 889 |

| Long Exposure (% of NAV) | 233.03% |

| Short Exposure (% of NAV) | 162.35% |

Annualized Total Returns

As of March 29, 2024

| MTD | YTD | 1YR | Since Inception 12/16/2021 | Gross Expense Ratio | Net Expense Ratio* | |

|---|---|---|---|---|---|---|

| AQR Sustainable Long-Short Equity Carbon Aware Fund | 7.74% | 15.86% | 38.07% | 24.97% | 2.93% | 1.37% |

| 50% MSCI World Index + 50% 3-Month Treasury Bill Index | 1.82% | 5.03% | 15.01% | 4.77% |

| AQR Sustainable Long-Short Equity Carbon Aware Fund | 50% MSCI World Index + 50% 3-Month Treasury Bill Index | |

|---|---|---|

| MTD | 7.74% | 1.82% |

| YTD | 15.86% | 5.03% |

| 1YR | 38.07% | 15.01% |

| Since Inception 12/16/2021 | 24.97% | 4.77% |

| Gross Expense Ratio | 2.93% | |

| Net Expense Ratio* | 1.37% |

As of March 29, 2024

| QTD | YTD | 1YR | Since Inception 12/16/2021 | Gross Expense Ratio | Net Expense Ratio* | |

|---|---|---|---|---|---|---|

| AQR Sustainable Long-Short Equity Carbon Aware Fund | 15.86% | 15.86% | 38.07% | 24.97% | 2.93% | 1.37% |

| 50% MSCI World Index + 50% 3-Month Treasury Bill Index | 5.03% | 5.03% | 15.01% | 4.77% |

| AQR Sustainable Long-Short Equity Carbon Aware Fund | 50% MSCI World Index + 50% 3-Month Treasury Bill Index | |

|---|---|---|

| QTD | 15.86% | 5.03% |

| YTD | 15.86% | 5.03% |

| 1YR | 38.07% | 15.01% |

| Since Inception 12/16/2021 | 24.97% | 4.77% |

| Gross Expense Ratio | 2.93% | |

| Net Expense Ratio* | 1.37% |

Performance data quoted represent past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. All returns shown are total returns that assume reinvestment of dividends and capital gains. Returns for periods under a year are cumulative, all others are average annual returns. Investment returns and principal will fluctuate with market and economic conditions and you may have a gain or loss when you sell shares. From time to time the Fund’s advisor may waive fees or reimbursed expenses, without which performance would have been lower. Please call 866-290-2688 for most recent month-end performance.

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI world index does not offer exposure to emerging markets. Indexes are unmanaged and one cannot invest directly in an index.

The ICE Bank of America Merrill Lynch 3 Month T-Bill Index is an index that tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. Indexes are unmanaged and one cannot invest directly in an index.

Cliff Asness

Managing & Founding Principal

- 32 years of experience

- 26 years at AQR

Ph.D., M.B.A., University of Chicago

B.S., B.S., University of Pennsylvania

John M. Liew

Founding Principal

- 31 years of experience

- 26 years at AQR

Ph.D., M.B.A., University of Chicago

B.A., University of Chicago

Michele L. Aghassi

Principal

- 25 years of experience

- 18 years at AQR

Ph.D., Massachusetts Institute of Technology

B.S., Brown University

Andrea Frazzini

Principal

- 19 years of experience

- 15 years at AQR

Ph.D., Yale University

M.S., London School of Economics

B.S., University of Rome III

John J. Huss

Principal

- 20 years of experience

- 14 years at AQR

S.B., Massachusetts Institute of Technology

Investment Minimums

| Individual Investors | $5 Million |

|---|---|

| Institutional Investors | None |

| Accounts Offered by Financial Advisors | None |

Shareholder Fees

| Sales Load | None |

|---|---|

| Deferred Sales Load | None |

| Redemption Fees | None |

Annual Fund Operating Expenses

| Management Fee | 1.10% |

|---|---|

| Distribution (12b-1) Fee | None |

| Other Expenses | |

| Dividends On Short Sales and/or Interest Expense | 0.05% |

| All Other Expenses | 1.76% |

| Acquired Fund Fees | 0.02% |

| Gross Expenses | 2.93% |

| Less: Expense Reimbursements | 1.56% |

| Net Expenses* | 1.37% |

| Adjusted Expense Ratio** | 1.32% |

|---|

**Reflects the Net Expense Ratio adjusted for certain investment related expenses, such as interest expense from borrowing and repurchase agreements and dividend expenses from investments on short sales, incurred directly by the Fund, none of which are paid to the Advisor.

An investment in any of the AQR Funds involves risk, including loss of principal. The value of the Funds’ portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad. Please refer to the prospectus for complete information regarding all risks associated with the Funds. An investor considering the Funds should be able to tolerate potentially wide price fluctuations. The Funds are subject to high portfolio turnover risk as a result of frequent trading, and thus, will incur a higher level of brokerage fees and commissions, and cause a higher level of tax liability to shareholders in the Funds. The Funds may attempt to increase its income or total return through the use of securities lending, and they may be subject to the possibility of additional loss as a result of this investment technique.

Information about how each Fund voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30 will be available no later than August 31. Please click here to view the most recent Form N-PX for the AQR Funds.

PRINCIPAL RISKS:

Investing in securities that meet ESG criteria may result in the fund forgoing otherwise attractive opportunities, which may result in underperformance when compared to funds that do not consider ESG factors.

This Fund is new and has a limited operating history.

The Fund’s use of derivative instruments and short positions exposes the Fund to additional risks, such as increased volatility, risk of default by the counterparty to the transaction and possible losses greater (sometimes substantially) than the Fund's initial investment as well as increased transaction costs. Investments in foreign and emerging markets involves risks not associated with investments in US markets, such as currency fluctuations and political and regulatory uncertainty. Funds that have exposure to mid and small-cap companies generally will experience greater price volatility. The Adviser employs various hedging techniques. It is not possible to hedge fully or perfectly against any risk, and hedging entails its own costs.

Sustainable investing is qualitative and subjective by nature, and there is no guarantee that the environmental, social and governance (“ESG”) criteria utilized, judgment exercised, or techniques employed, by AQR will be successful, or that they will reflect the beliefs or values of any one particular investor. Certain information used to evaluate ESG factors, including, but not limited to, the carbon emissions of the companies to which the Fund has exposure, or a company’s commitment to, or implementation of, responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete. ESG investing can limit the investment opportunities available to a portfolio, such as the exclusion of certain securities or issuers for nonfinancial reasons and, therefore, the portfolio may perform differently than or underperform other similar portfolios that do not apply ESG factors.

Please review the Fund’s prospectus for additional details regarding the risks associated with an investment in the Fund

This Fund is not suitable for all investors. An investor considering the Funds should be able to tolerate potentially wide price fluctuations.

An investment in the Fund is subject to risks, including the possibility that the value of the Fund’s portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad.

There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results. Diversification does not eliminate the risk of experiencing investment losses. This document is intended exclusively for the use of the person to whom it has been delivered by AQR and it is not to be reproduced or redistributed to any other person without AQR’s written consent.

© AQR Funds are distributed by ALPS Distributors, Inc. AQR Capital Management, LLC is the Investment Manager of the Funds and a federally registered investment adviser. ALPS Distributors is not affiliated with AQR Capital Management.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus or summary prospectus containing this and other important information, please call 1-866-290-2688 or click here to view or download a prospectus online. Read the prospectus carefully before you invest.

View definitions of benchmarks and other terms used here.

Diversification does not eliminate risk. Indexes are unmanaged and one cannot invest directly in an index.

Prior to October 18, 2021 the AQR Macro Opportunities Fund was known as the AQR Global Macro Fund.

The information provided herein (including any separate documents that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information about our products and services and to otherwise provide general investment education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as none of AQR Capital Management, LLC (“AQR Capital”) nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act of 1974, as amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein. If you are an individual retirement investor, contact your financial advisor or other fiduciary unrelated to AQR about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

There are risks involved with investing including the possible loss of principal.

Past performance does not guarantee future results.

©2023 AQR Funds. All rights reserved.